How To Use Candlestick Charts For Effective Trading Analysis

How to use Castlestick charts in an effective trading analysis

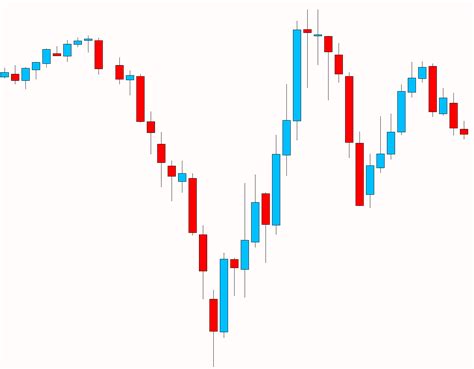

The candlestick charts for decades were a technical analysis kiosk in financial markets. These visual images of movement and price trends are widely used by merchants, investors and analysts to analyze market behavior and make reasonable negotiation decisions. In this article, we will go into the world of candle charts and investigate how to efficiently use them for negotiation analysis.

What are the candle charts?

Candlestick charts are a type of technical chart showing tall, low, open, closed and volume prices (HHLVO) for certain stocks or assets for a specific period. This graphics are created by designing horizontal lines on the level of the network, which reflects the cost movement and trends.

Types of candle charts

There are several types of candle charts used by traders to analyze market behavior:

1

2.

3.

4.

How to read candlestick graphics

Reading candle schedules requires some knowledge of the basic concepts of technical analysis such as:

1

2.

- VOLIAN Analysis

: Consider the volume of the chart to evaluate the sense of market and impulse.

Effective Candle Diagram Analysis

To effectively use candle charts for negotiation analysis, follow the following steps:

1

- Analyze graphics : View the candle model and try to set trends, supports and resistance.

- Search Standards : Set all repetitive standards such as waves, triangles or wedges.

4.

- Consider market conditions

: Take into account market conditions such as news events or economic permits.

Samples of candle chart **

Here are some examples of candle charts used for negotiations:

- High graph showing a long -term trend and large volume of day candle chart:

`

+————-+————-+—————+

| H | L | O |

| 2013-10-13 | 2023-2023 | 25-28-2023 |

+————-+————-+—————+

`

- Low graph of a short -term trend and a small day candle chart:

`

+————-+————-+—————+

| H | L | O |

| 15-18-2023 | 25-28-2023 | 30-33-2023 |

+————-+————-+—————+

`

Conclusion

Candle charts are a powerful tool for analyzing market behavior for merchants and investors and making reasonable trade decisions. Understanding of various types of candle charts, identifying -cataling models and using technical indicators along with graphics analysis, you can create effective negotiation strategies to help successfully in markets.

Remember that candle charts are just part of the negotiation strategy.